Like it or not, some of the best-performing stocks in the market have been “vice” stocks – alcohol, tobacco, and, depending on the month, cannabis.

Think of Jack Daniel’s whiskey, Budweiser beer, and Marlboro cigarettes.

As these brands became globally dominant, the companies that own them have created tremendous value for shareholders through the years.

Their products do well when the economy is strong (“let’s celebrate!”) and even better when the economy is tanking (“let’s drown our sorrows…”).

At the same time, these companies are often mired in controversy and are frequent targets of the media and government.

The latest product to come into the government’s crosshairs is electronic cigarettes…

Last week, the Centers for Disease Control and Prevention (“CDC”) and U.S. Food and Drug Administration (“FDA”) just launched a widespread investigation following a spate of “cases of lung injury associated with the use of e-cigarette or vaping products.”

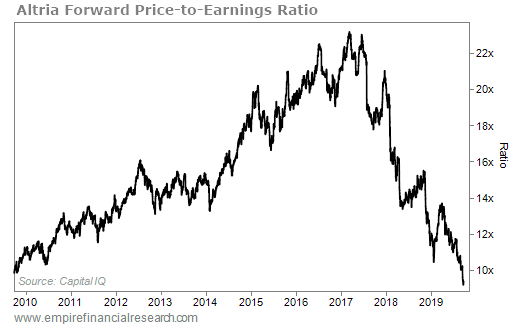

The news has spooked investors out of Altria (NYSE: MO), the largest cigarette company in the U.S., whose stock is now at its cheapest valuation level in a decade, making it a fantastic buying opportunity right now.

Altria’s brands include Marlboro, Parliament, and Virginia Slims. But the reason its shares have been hammered has more to do with the 35% stake it has in leading e-cigarette company Juul, which has come under tremendous scrutiny for marketing its products to teenagers and young adults.

I believe that Altria is at a major crossroads in which one of two things will happen…

1. Juul will survive the scrutiny and continue to take market share, which would be bad for Altria’s cigarette business, but good for its stake in Juul), or

2. Juul will be forced to rein in its sales, which would be bad for Juul, but good for Altria’s cigarette business.

Either way, Altria wins.

Another factor weighing the stock down was that investors were concerned about a potential merger with former corporate partner Philip Morris International (PM). I have a contrary opinion that a merger between the two companies would increase growth and reduce costs. Regardless, earlier this morning, Altria called off the merger. (Shares are down 3% on the day as of midday trading.)

The stock has now fallen to its lowest price in more than five years and, as you can see in the following chart, the lowest forward price-to-earnings multiple in more than a decade…

It’s also worth noting that Altria owns a roughly 10% stake in Anheuser-Busch InBev (BUD) as well as its stake in Juul and cannabis company Cronos (CRON).

Stripping out these stakes, Altria shares are trading at valuation levels not seen since the days before the Tobacco Master Settlement Agreement in 1998.

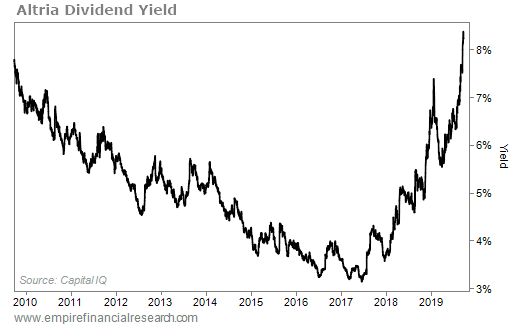

The sell-off has also pushed the company’s dividend yield to a massive 8.2% at today’s levels – the highest it’s been in more than a decade…

To put that in perspective, the 10-year U.S. Treasury bond yields less than

2%, or roughly one-fifth of Altria’s payout.

Importantly, Altria’s free cash flow covers the dividend, so there’s little chance that the company cuts it.

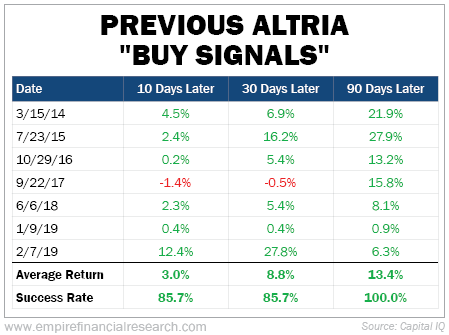

Of course, just because it’s cheap doesn’t mean shares have to go up… But Altria shares are so deeply “oversold” that historically, a short-term rally almost always follows.

I focus on the relative strength index (“RSI”) as a measure of investor sentiment. When a stock’s RSI falls below 30, it means the sell-off is overdone. Last week, Altria shares reached their most oversold level in five years.

As you can see, in the seven instances where Altria has gotten this oversold within the past five years, shares almost always pop higher…

Across almost every one of these time frames, buying the stock during these oversold periods has generated quick gains.

On average, you’d be up 13.4% after 90 days – good for a 65% annualized return!

Our trading strategy involves looking for extremes. Today, we’re seeing extremes in both valuation and negative investor sentiment.

One of the keys is to buy the stock after it has shown some stability and the RSI has risen back above 30. This happened earlier this week – and on top of the company reaffirming guidance for the year and the breaking merger news, these are tailwinds for the stock to continue higher.

Though Altria’s business still faces some long-term uncertainty, the company has shown an ability to address these concerns and deliver value to shareholders.

Buying a strong, global brand at 10-year-low valuations amidst peak investor negative sentiment is one of the strongest trading setups I’ve found in my two-plus decades on Wall Street. This sell-off is way overdone, giving investors a historically attractive opportunity. You won’t want to miss out on it…

Buy Altria (NYSE: MO) up to $43 a share. Use a hard stop loss at $30 once you’ve established a position.

Regards,

Enrique Abeyta