1) This is astoundingly impressive, especially since this is Tesla's (TSLA) least productive factory: Tesla Now Runs the Most Productive Auto Factory in America. Excerpt:

Elon Musk has a very specific vision for the ideal factory: densely packed, vertically integrated and unusually massive. During Tesla Inc.'s early days of mass production, he was chided for what was perceived as hubris. Now, Tesla's original California factory has achieved a brag-worthy title: the most productive auto plant in North America.

Last year Tesla's factory in Fremont, California, produced an average of 8,550 cars a week. That's more than Toyota Motor Corp.'s juggernaut in Georgetown, Kentucky (8,427 cars a week), BMW AG's Spartanburg hub in South Carolina (8,343) or Ford Motor Co.'s iconic truck plant in Dearborn, Michigan (5,564), according to a Bloomberg analysis of production data from more than 70 manufacturing facilities.

In a year when auto production around the world was stifled by supply-chain shortages, Tesla expanded its global production by 83% over 2020 levels. Its other auto factory, in Shanghai, tripled output to nearly 486,000. In the coming weeks, Tesla is expected to announce the start of production at two new factories—Gigafactory Berlin-Brandenburg, its first in Europe, and Gigafactory Texas in Austin. Musk said in October that he plans to further increase production in Fremont and Shanghai by 50%.

I took a tour of the Fremont factory on April 11, 2013 with my buddy Patrick Blott and my cousin's wife – here's a picture of us that day:

I was very impressed with the factory, but for some stupid reason didn't buy the stock, which was a very costly mistake. Adjusted for the subsequent 5:1 split, it closed that day at $8.72, meaning it's up 105 times since then – ARRRRHHHH!!!!

2) Almost exactly two years ago on February 5, 2020, we released an in-depth video detailing why we were incredibly bullish on electric and autonomous vehicles and how these new technologies would lead to the creation of an enormous, world-changing new industry called Transportation as a Service (TaaS). You can watch the latest version of it here.

At the end of the video, we made a special offer to receive a year of our flagship Empire Stock Investor newsletter for only $49, which also included three reports recommending our five favorite EV/AV stocks, which have risen an average of 100% (through yesterday's close) versus only 30% for the S&P 500 index. (The offer is still open – to take advantage of it, just click here.)

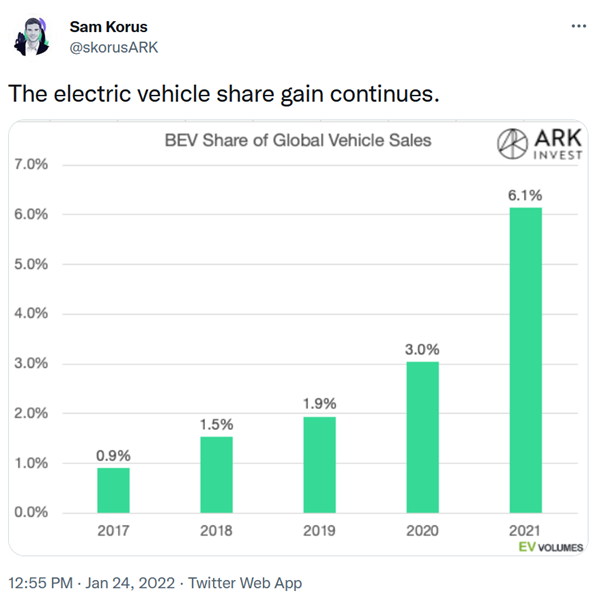

Our thesis is playing out pretty much as we expected. Autonomous driving technology is advancing rapidly and being incorporated into more and more vehicles, and electric vehicle sales and market share are in the early stages of hockey-stick growth, as you can see in this chart:

I think this is dead wrong: Does Anyone Want an Electric Car?

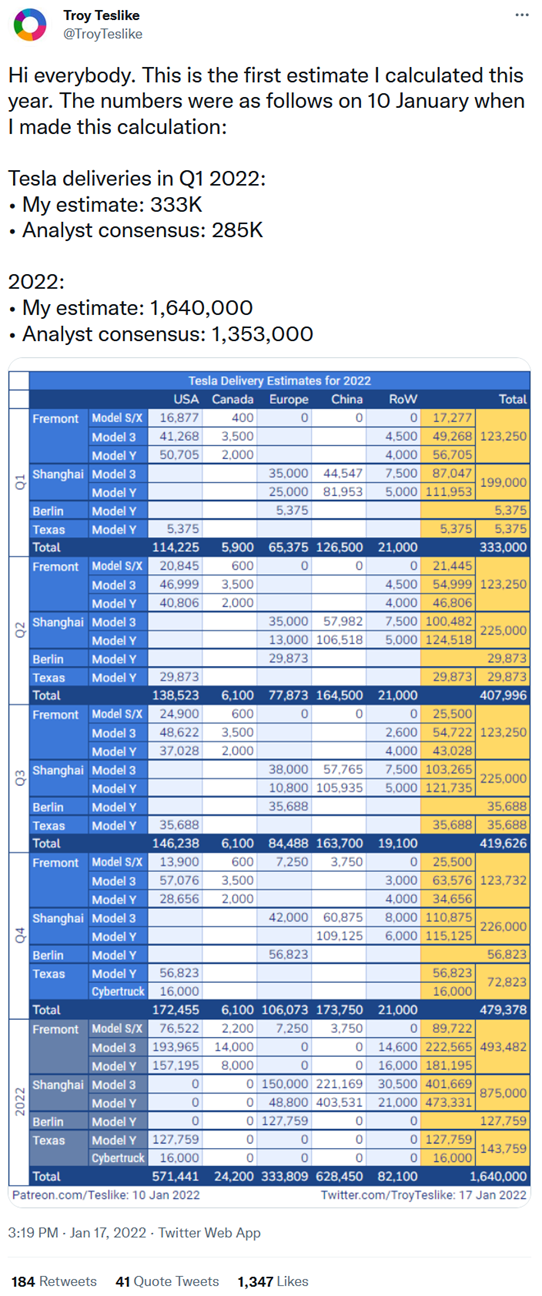

3) Troy Teslike's predictions have been quite accurate in the past – here's his forecast for 2022 deliveries:

4) Here's an insightful story by Bloomberg's Matt Levine about JPMorgan Chase's (JPM) lawsuit against Tesla: Tesla v. JPMorgan (I especially love the last line – so true!). Excerpt:

Last November, JPMorgan sued Tesla demanding an extra $162.2 million due to a disagreement about a technical adjustment to the terms of the warrants. This seems very petty! JPMorgan was up $5 billion; let the other $162 million go...

Yesterday Tesla filed a counterclaim against JPMorgan and it is pretty compelling. Here is the filing. They do kind of lead with the "come on you already made so much money" point:...

It is worth mentioning — and Tesla does mention — that three other banks had bought similar warrants from Tesla in the same transaction as JPMorgan, and none of them thought to adjust their warrants for Musk's tweeting.

I am actually a bit at a loss about what is going on here? One possibility is that JPMorgan's derivatives trading desk really did think that the right thing to do in 2018 was to adjust the warrants, they then hedged the trade based on a lower strike price for three years, and reversing the adjustment now would cause them to lose money. That seems weird but not impossible.

Tesla's explanation is simpler:

The windfall JPM demanded bore no relationship to any purported economic effect on the Warrants. On information and belief, JPM pressed its exorbitant demand as an act of retaliation against Tesla both for it having passed over JPM in major business deals and out of senior JPM executives' animus toward Mr. Musk.

That seems to tie to this Wall Street Journal article about how "Elon Musk and Jamie Dimon don't get along," which notes that JPMorgan hasn't done any Tesla investment banking work since 2016 and has missed out on some opportunities to finance Tesla's cars. I guess? It seems odd to file a nine-digit lawsuit about corporate events adjustments in equity derivatives trades out of personal pique, but odd things do happen a lot to Tesla.

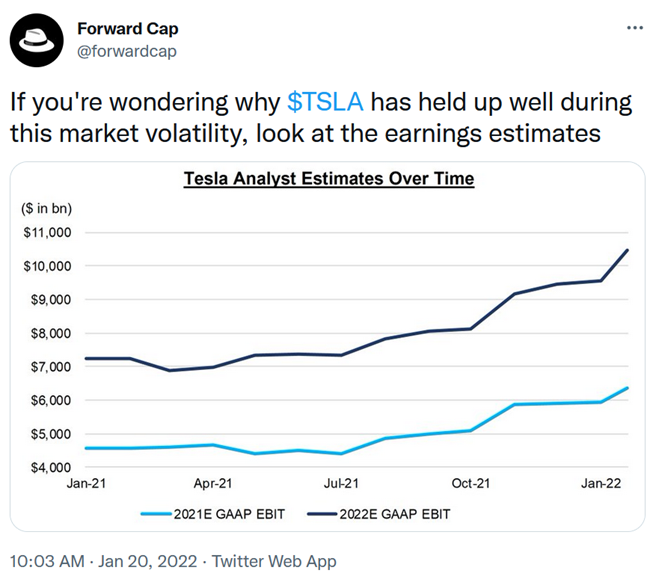

5) Interesting tweet:

6) Other articles of interest I don't have time to comment on:

- Is Norway the Future of Cars?

- When Will EVs Go Mainstream? It Depends on Uncle Sam

- GM Delivered Only 26 EVs In Q4 2021, Including Just 1 Electric Hummer

- For Maximum EV Efficiency, Stick to 25 Miles an Hour, Ignore Angry Drivers

- Ford F-150 Lightning EV pricing revealed, online configuration tool live

- Nickel hits 10-year high as electric vehicle production ramps up

- Smart Headlights Are Finally on Their Way

Best regards,

Whitney